Empowering Investors

since 1995

“At Astor Realty Capital, we believe in breaking traditional boundaries by leveraging our collective bargaining power. We are dedicated to leading our community of investors toward financial security and growth with integrity, authenticity, and transparency. For us, it’s not just business; it’s personal.”

Astor Realty Capital is an institutionally backed private equity firm investing across the capital stack in ground-up and value-add projects in top-performing U.S. markets.

Astor Realty Capital is a private equity firm supported by high net worth individuals, family offices, and institutional investors. We specialize in ground-up and value-add projects across the capital stack. Our goal is to build programmatic partnerships with top-tier developers in select high-performing U.S. markets, enabling us to strategically invest for maximum returns.

14.5–16% Projected Net Returns With Current Cash Flow

A new credit & preferred equity income strategy, offering investors consistent cash flow, strong downside protection, and access to Astor’s institutional deal flow.

ADVANTAGES OF WORKING WITH ASTOR

Managing risk & achieving high yields

What Our Investors Have To Say

The Astor Team is a group of knowledgeable and professional individuals who work hard to make sure you get the best investment portfolio possible. They always take time to answer any questions I have in a timely and professional manner. I’ve been investigating with them for a number of years now and plan to continue for many years to come.

Maya G. Astor Investor Since 2018

Astor exceeded my investment expectations as they are selective with their projects, they keep me informed at all times, and it’s a very personal experience. I love the fact that Joe & Michael invest their own capital in every project.

Elena G. Astor Investor Since 2018

I am grateful for the opportunity to invest with Astor as I can sit back and know my money is working for me.

John G. Astor Investor Since 2020

It’s all about trust and confidence. Joe and Laura go out of their way to educate on new offerings and provide extensive updates on the existing investments I have made. They really put your interests first and foremost. I highly recommend you take a look. You won’t be disappointed.

Rob S. Astor Investor Since 2020

We’ve built an investment platform based on iron-clad principles; preservation of capital, transparency, and risk management

Bay Harbor, Florida

Ground-up development of an 18-unit boutique luxury condo in Miami’s most desirable neighborhood, Bay Harbor Islands

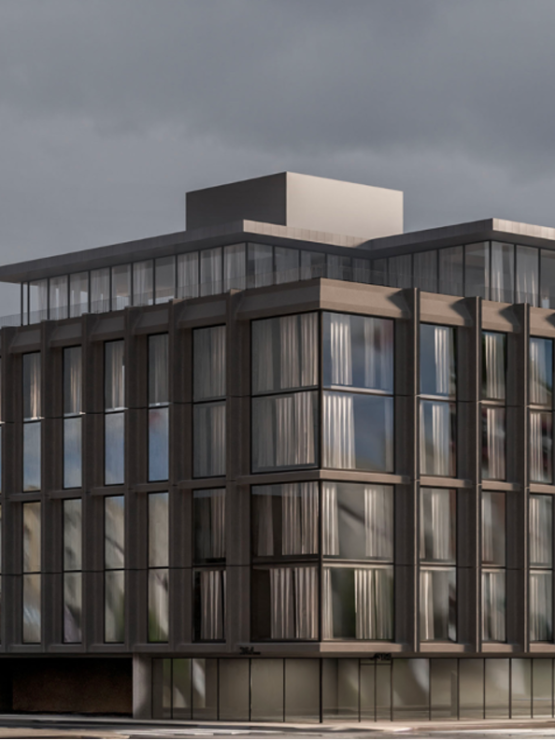

Downtown Miami, FL

New Construction Luxury Mixed-Use Building. Miami’s First Lifestyle Hotel, Condominium & Office Building

$713,000,000

Scottsdale, Arizona

247,000 net SF featuring 265 Rooms incl. Penthouse & luxury suites, 7,000 SF high-end conference center, premiere rooftop pool experience & 2 restaurants

$165,126,000

Columbus, Ohio

105,191 SF Cold Storage Facility Value Add Acquisition in Columbus, Ohio.

$23,327,000

Avenue U, Gravesend BK

33,000 SF 16-unit luxury residential condo development in the Gravesend neighborhood of Brooklyn.

$42,660,000

Dallas-Fort Worth, Texas

205-Unit Multifamily Value-Add Opportunity in the Dallas-Fort Worth suburb of Arlington, TX.

$37,730,000

Dania Beach, FL

243,089 SF new construction multifamily rental building featuring 293 units over 8 stories

$121,400,000

Avenue U, Gravesend NY

33,000 SF 12-unit luxury residential condo development in the Gravesend neighborhood of Brooklyn

$49,875,000

Flemington, New Jersey

89,572 SF new construction mixed-use rental building in Flemington, NJ

$36,239,000

Learn More