Commercial Real Estate Investment Solutions

INVESTMENT CRITERIA

Astor has invested in more than $2.27 Billion of equity and development deals and seeks opportunistic and value-added investments in most asset classes.

As a trusted source of debt and equity, our partners benefit from consistent and fast-acting capital capable of structuring investments to fit nuanced transactions.

LP Equity

$5,000,000 – $10,000,000- HOLD 4 Years Maximum

- TARGET RETURNS 1.60x Minimum Multiple

- ASSET CLASS ultifamily, Condo, Industrial, Hotel, and Others on Case-by-Case Basis

- LOCATION FL, NY, TX, AZ, and Other Select MSAs

- PURPOSE Ground-Up Development, Land Pre-Development & Entitlement, Adaptive Reuse, Construction Completion

Preferred Equity

$5,000,000 – $50,000,000- HOLD 24-48 Months

- TARGET RETURNS Starting at 14.00%

- ASSET CLASS Multifamily, Condo, Industrial, Hotel, and Others on Case-by-Case Basis

- LOCATION FL, NY, TX, AZ, and Other Select MSAs

- PURPOSE Ground-Up Development, Land Pre-Development & Entitlement, Adaptive Reuse, Construction Completion

DEBT

$5,000,000 – $50,000,000- HOLD 12-36 Months

- TARGET RETURNS SOFR + 650

- ASSET CLASS Multifamily, Condo, Industrial, Hotel, and Others on Case-by-Case Basis

- LOCATION FL, NY, TX, AZ, and Other Select MSAs

- PURPOSE Ground-Up, Construction Completion, Lease-Up, Value-Add, Entitled Land

Submit an Opportunity

Our capital solutions team has over 65 years of combined commercial real estate experience, closing over $2.27 in transactions.

Astor’s team has over 65 years of combined principle experience

operating in multiple markets and asset classes

Scottsdale, Arizona

247,000 net SF featuring 265 Rooms incl. Penthouse & luxury suites, 7,000 SF high-end conference center, premiere rooftop pool experience & 2 restaurants

$165,126,000

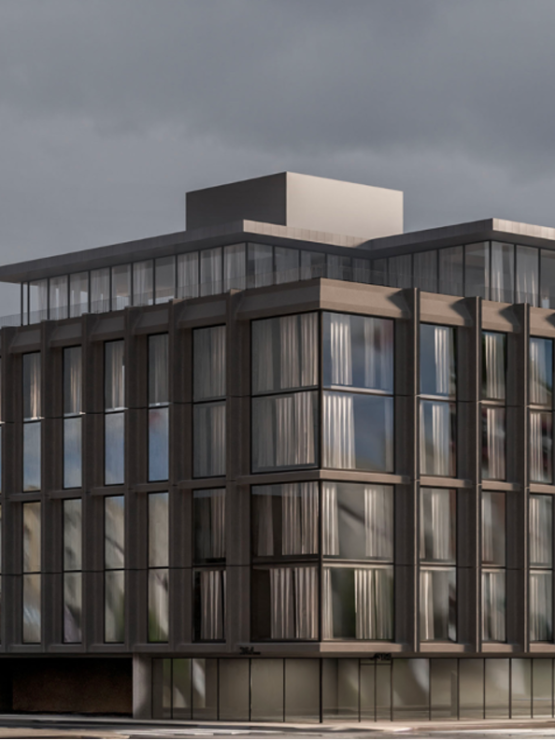

Downtown Miami, FL

New Construction Luxury Mixed-Use Building. Miami’s First Lifestyle Hotel, Condominium & Office Building

$713,000,000

Columbus, Ohio

105,191 SF Cold Storage Facility Value Add Acquisition in Columbus, Ohio.

$23,327,000

Avenue U, Brooklyn, NY

33,000 SF 12-unit luxury residential condo development in the Gravesend neighborhood of Brooklyn

$49,875,000

Dallas-Fort Worth, Texas

205-Unit Multifamily Value-Add Opportunity in the Dallas-Fort Worth suburb of Arlington, TX.

$37,730,000

Avenue U, Gravesend BK

33,000 SF 16-unit luxury residential condo development in the Gravesend neighborhood of Brooklyn.

$42,660,000

What Our Developing Partners Have To Say

We are proud to have such accomplished partners join together with us on the road through our development projects. Astor’s insight, knowledge, and ideas have been a tremendous asset to us and we look forward to partnering together on many more successful deals!

Joel S. South Side Units

We are glad to be working with Astor and look forward to working together on many more successful deals.

Daniel Kodsi, CEO Royal Palm Companies

It’s been a great experience working with the Astor group. Their deep understanding of real estate development was a contributing factor. They always find a way to turn a challenge into a solution

Abraham J. Allstate Ventures

Partnering with such amazing professionals has proven immeasurable to the continued growth and success of our individual projects and our development company as a whole. Astor’s deep market knowledge and experience has been a real asset.

Lee Cohen CEO REDHOEK+PARTNERS

If you’re a developer or operator seeking an equity partner, contact us

How does the Astor platform work for real estate companies or “sponsors”?

If you’re a real estate company or developer interested in raising equity capital please contact us for more information.

What is Astors check size?

Astor invests LP equity into projects with average check sizes of $4-18 Million

What our Astor’s general terms?

Experienced local partners with boots on the ground

20% Sponsor Equity

Preferred Returns: 8%-12%

Returns: Ground up 2x+/Value Add High Teens

to Low Twenties IRR

What will Astor invest into?

Project Type: Ground Up/Value Add

Project Length: 3 – 4 Years

All Asset Classes in Major U.S Markets