You work hard for your money. We want your money to work just as hard for you.

Invest in Commercial Real Estate

About Astor

Astor Realty Capital is an institutionally backed private equity firm guided and led by seasoned professionals with tested market cycle strategies.

Our strategy is to invest smart capital in high-quality real estate ventures with relatively short durations to grow and preserve our partner’s investments.

Astor currently participates in over 3.65 million square feet and $2.27 billion of assets in 12 sub-markets with returns that surpass the industry average.

We Built Our Platform Based On Ironclad Principles

Preservation of Capital

Ensuring the safety of your hard earned money is of utmost importance to Astor.

Hands-on Asset Management

While Astor forms ventures with best-in-class operators, our in-house asset management team, tracks, monitors, & reports performance while analyzing market externalities to ensure our investment outcomes in real-time, at all times.

Market Return

Astor has proven success in outperforming expectations and delivering superior risk-adjusted returns consistently.

Alignment of Interests

Investing our private capital alongside our investors in every transaction. Astor’s mission is to be a trusted collaborative long-term partner.

Personal Approach

Astor’s network has grown from a trusted circle of friends and family into an international investment platform maintaining its core principles of accessibility by ensuring investors have direct access to our professional staff and executives.

Diversification

Astor’s access to institutional opportunities in diverse geographic locations and asset classes allowed our investors to create a well-balanced portfolio.

16.3%-18.0% Projected Annually – Preferred Equity with Current Pay

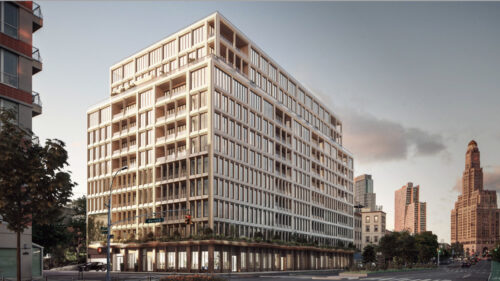

49-Unit Ground-Up Affordable Rental Brooklyn, NYC

Addressing a significant market gap, this investment taps into the urgent need for affordable housing in NYC, providing a secure and high-demand investment!

Astor’s Historic Performance

East New York, NYC

227-Unit Mixed-Use Residential Rental Development

24.7% Annual Returns

South Tampa, Florida

136 Unit Apartment Complex Value Add Acquisition

Common Equity

25 Month Term

50% Annual Returns

1400 W Monroe, Chicago IL

Ground-up 42 Unit Luxury Condos

Common Equity

50 Month Term

19.3% Annual Returns

Brooklyn Heights, NY

Historic Brownstone Renovation

Mezzanine Debt

9 Month Term

18% Annual Returns

Downtown Brooklyn, NY

Mixed-Use Residential Condo Ground Up Development (100 Units + Retail)

Common Equity

52 Month Term

24% Annual Returns

Bed-Stuy, Brooklyn

7 Building Multi-Family Portfolio

Mezzanine Debt

14 Month Term

17% Annual Returns

Tribeca, NYC

Re-positioning 4 mixed-use loft buildings portfolio

Preferred Equity

24 Month Term

15% Annual Returns

ADVANTAGES OF WORKING WITH ASTOR

Managing risk & achieving high yields

HEAR FROM ASTOR INVESTORS

The Astor Team is a group of knowledgeable and professional individuals who work hard to make sure you get the best investment portfolio possible. They always take time to answer any questions I have in a timely and professional manner. I’ve been investigating with them for a number of years now and plan to continue for many years to come.

Maya G. Astor Investor Since 2018

Astor exceeded my investment expectations as they are selective with their projects, they keep me informed at all times, and it’s a very personal experience. I love the fact that Joe & Michael invest their own capital in every project.

Elena G. Astor Investor Since 2018

I am grateful for the opportunity to invest with Astor as I can sit back and know my money is working for me.

John G. Astor Investor Since 2020

Astor guided me through the process of making a sound financial decision for our family. Most importantly, they took the time to make sure we understood every aspect of the transaction until we felt 100% comfortable.

Moshe T. Astor Investor Since 2018

Our investors keep coming back.

Learn why so many of our investors are repeat investors.

It’s all about trust and confidence. Joe and Laura go out of their way to educate on new offerings and provide extensive updates on the existing investments I have made. They really put your interests first and foremost. I highly recommend you take a look. You won’t be disappointed.

Rob S. Astor Investor Since 2020

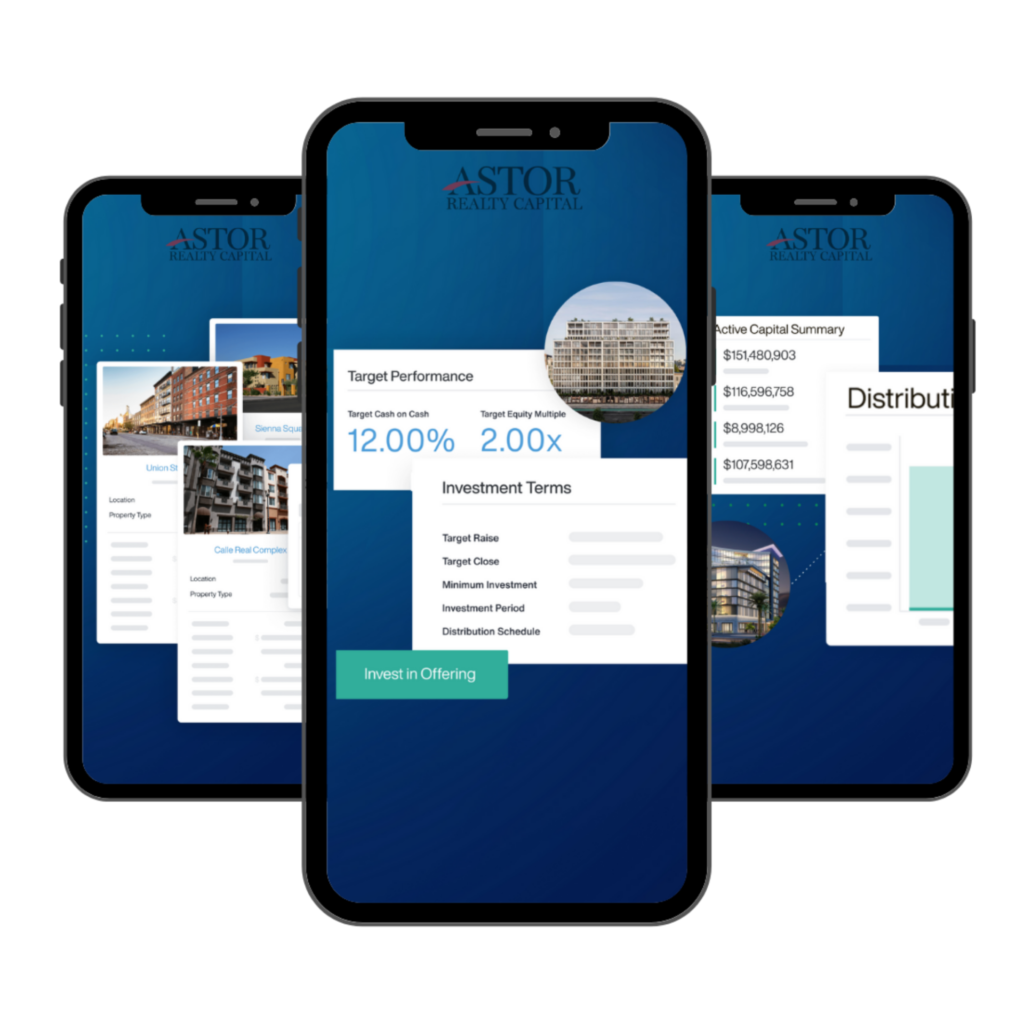

MANAGE YOUR INVESTMENTS

Invest and manage your portfolio 24/7 with our easy-to-use website and mobile app.

We’re here to help

How can I view Astors investment opportunities?

Complete the sign up form accessed from any sign up / register button throughout the site. You will then start receiving all investment opportunities from Astor. If you choose to participate in an investment, you will have to get verified as an accredited investor.

I am interested in investing a small amount in a solid real estate investment opportunity. Is Astor suitable for me?

We can work with accredited investors and our approach is to make sure the investment is right for you, in terms of investment criteria and amount. Most of our investments start from amounts as low as $25,000.

What is an accredited investor?

An accredited investor is a term used by the U.S. Securities and Exchange Commission

(SEC) under Rule 501 of Regulation D. An investor must fulfill at least one of the following to become accredited:

- Earn an individual income of more than $200,000 per year, or have a joint spousal income of more than $300,000 per year, in each of the last two years and expect to reasonably maintain the same level of income.

- Have a net worth exceeding $1 million, either individually or jointly with his or her spouse.

- Be a bank, insurance company registered investment company, business development company, or small business investment company.

- Be a general partner, executive officer, director, or a related combination thereof for the issuer of a security being offered.

- Be a business in which all the equity owners are accredited investors.

- Be an employee benefit plan, trust, charitable organization, partnership, or company with total assets over $5 million.

What Risks are involved?

As with any investment, Astors investments carry risk, which may occur due to fluctuations in the real estate market, unforeseen circumstances, or failure to perform on the business plan.

Why should I invest with Astor?

Access quality real estate investments that were once exclusive to high-net-worth or institutional investors. These investments have passed our rigorous due diligence process.

In addition, when you invest with Astor, you gain access to a team of professionals with over 60 years of experience in managing the risk and potential pitfalls associated with real estate investments.

Accredited investors may choose from diverse real estate investments and start investing for as little as $25,000.

Benefit from complete transparency and professional oversight. Our work doesn’t stop at funding. Once a deal is closed, the project is overseen by our analyst team and measured against the project’s pre-approved business plan. In addition, you will receive ongoing reports regarding the progress of your investment, from initial investment through to exit.